Don’t let your Dream Home become your ‘Nightmare Home’. These three simple strategies will open the door to your dream home. Understand the principles of debt and equity to achieve your Dream Home in record time.

Do you have a Dream Home?

When I was a child I always had my dream home. In those days the ‘must have’ home was a Mater Prize Home. People would que up for hours to go through these homes. I remember whole rows of them in the suburbs which were then on the fringe of Brisbane. My grandparents always bought a ticket. They told me that if we won, the whole family would move to this fantastic home. I always knew the date for the next prize draw and I would rush home from school hoping to hear we had won. Of course this never happened….. and it never happened for hundreds of thousands of people we wanted the same dream home.

I will let you into a little secret. I still can’t resist the chance to win a dream home. But because I now live in my dream home, I have changed by focus. I look for art unions which have the dream investment property like a set of apartments. I know my chance of winning is less than 0.0000000001%, but I still like to dream about Dream Homes. My friend and I say, the price of the ticket is worth the dreams one can have. And of course the money does not to a good cause. Well that’s my logic.

You see people buy on emotion and then justify it by logic. Now this is a real trap for those who want to own their Dream Home. Before you buy your first property, you need to do some maths and work out what dream home you can afford, say by age 45. The place to start is a strategy to get to that Dream Home.

So let’s get down to the hard part and work out what you can afford for the Dream Home at age 45. The general consensus was the family home should cost four to five times your annual wage. With double income families, house prices have risen to match this increased income.

Let’s say we have a couple who are twenty-five and have a combined income of $250,000. If we keep to the old formula the dream home they can afford at age 25 should be between $1,000,000 (4 x $250,000) and $1,250,000 (5 x $250,000). Their work promotions, thir should income should be say $350,000 in 20-years’ time. Their target dream home is likely to be between $1,400,000 and $1,750,000 at that time.

There are other factors which you need to consider. These include your deposit and your debt servicing ratio, DSR, also called Loan to Value Ratio (LVR).

Do you have a 20% Deposit for your Dream Home?

If you can manage a 20% deposit, you will save thousands in mortgage insurance. On a $1,000,000 property, this is $200,000. In addition you will have all your purchase costs which are likely to be about 5% of the purchase price. This then is about 25% of the buying price of your home to meet the deposit and buying costs.

If you can’t save that 20% deposit, then you could consider buying a cheaper home.

Remember I am trying to help you buy your dream home, not your nightmare home.

Saving a 20% deposit, while renting is a big task. If your parents are willing, you may consider staying at home. Paying a little less rent, will help you save for the big move.

Another option is to consider ‘house sitting’. You need to have few possessions and ability to move about. Sometimes people are away for six to twelve months and this may work well for a year or two.

If you can’t save the deposit, then you are going to have much higher monthly loan payments. which again you may find you can’t afford. This will affect your lifestyle activities for the next twenty years.

Remember that buying your dream home is not a sprint, it is a marathon. Marathon runners who train and prepare for the race are the ones smiling as they cross the finish line.

Do you know your LVR – for your Dream Home Loan?

Another quick way to decide if you can afford your dream home is to calculate your LVR. This is the Loan to Value Ratio. In Australia, a more common term is Debt Servicing Ratio.

You need to check this out before to go to the bank because they will use this to see if you can afford you loan payments. This ratio is telling you what percentage of your after tax income is being used to repay the loan. So if you have 30% LVR, then you will be paying 30% of your after-tax salary to your loan.

Remember your loan payments is only the first cost for owning your home. Think about rates, insurance, electricity and repairs.

Lending intuitions don’t take into account your lifestyle choices. They don’t care if you can’t afford a night out at the movies or an annual holiday. But you should care. You need to separate wants and needs.

For me, a LVR of 30% – 35% is as high as one should go for committed loan payments. But, you can then plan to make extra payments. The advantage of this method is you don’t have to make those additional payments. The only effect is that you will take a bit longer to repay your loan.

I am sorry if things like deposits and LVR’s are not what you what to hear about. But, I am trying to get you into your dream home with a dream lifestyle.

I am going to give you three strategies that may help you achieve your long term dream home.

Strategy 1: Move up the property ladder slowly to reach your dream home.

In this strategy, you get onto the property ladder by purchasing a small, expensive apartment or home. The secret is to speed up the equity in each home purchase. As your income and home equity increase, you upgrade to the next level of affordability. Finally, you will reach your desired dream home.

You can do this in a number of ways:

- Rent out a spare bedroom

- Spend your spare time, doing renovations which will add value to the property

- Make extra payments to your loan.

- Get a second part-time job and use all this money to make extra payments.

The secret of this method is that you are not spending too much on interest costs. You can reduce that loan quickly.

Strategy 2: Buy your forever dream home which can be upgraded over time

The second strategy is to decide where you want to live long term. This may be the suburb where you will have good schools, good transport or good community facilities.

Do your research for that area and look for a home which has the potential to be your dream home. This home is likely to be more expensive so you may need to wait a little longer and save a bigger deposit.

There are some options here. You may buy a small home and plan to do an extension when you need extra space and when you have paid down your first loan.

Another option is to buy an un-renovated home which is the size you need. While the home may not have your dream kitchen when you buy it, things like that can come over time.

With this strategy, you would plan a buy the home, pay down the loan quickly. In due course, save the cash to make the improvements or refinance your loan to do the renovations.

Strategy 3: Let the tenants contribute to your dream home

With this strategy, you would rent something which is close to your employment. The aim would be that you could reduce costs by not having a car, or reducing car ownership to one.

Decide which is the dream location for your home and buy the property as an investment property. This way, you will have tenants contributing to loan payments. A bonus is the interest will be tax deductible. Remember that the time you rent the property will be subject to capital gains tax if you ever sell you dream home. But given your ownership if likely to be quite long, this should end up being only a small percentage of the profit.

One problem is that you will be paying rent and loan payments. This may need careful evaluation of the cash-flows to ensure you can manage both. You may need to look for a small rental apartment and ‘make do’ for a few years. In the long term, that extra sacrifice will be worth it.

Using Financial Mappers to test your dream home strategy

Financial Planning Software that includes Home Ownership

With Financial Mappers you can actually test your home ownership strategy. You can create a 50-year model which will let you plan your purchases and manage your debt.

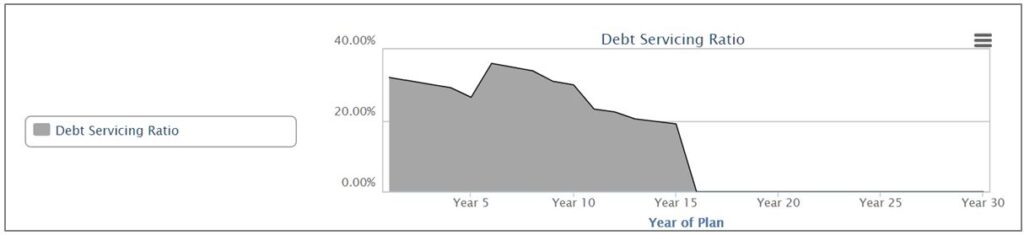

You can check your debt servicing ratio and your budget cash flows.

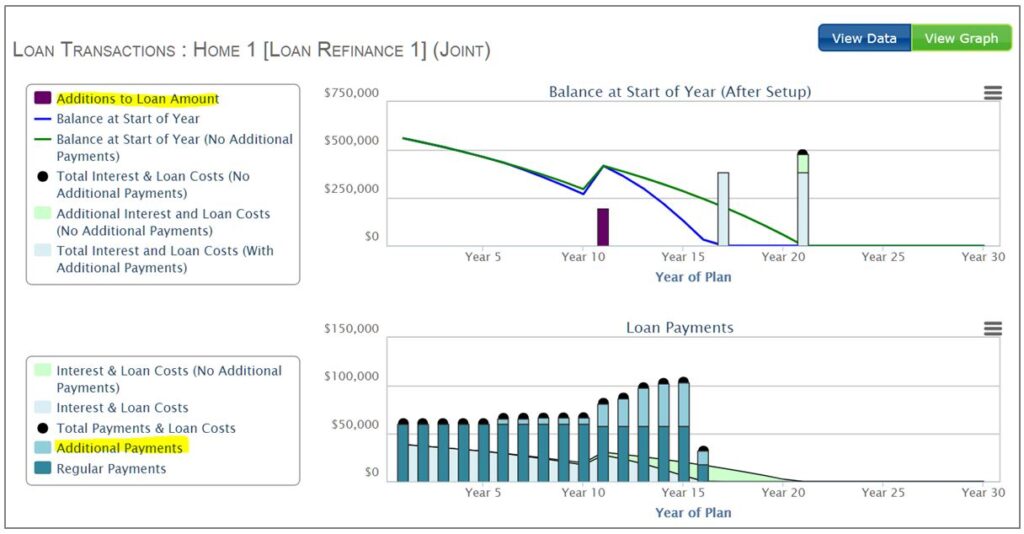

Here’s an example of someone who has moved up the property ladder by changing homes three times.

This graph lets you check your debt ratio.

In this example, the home has undergone a major renovation in Year 10.

Tips from MoneySmart for buying your home

Buying ahome, is going to be your first major purchase. For many, it will be the largest investment they make for quite some time.

I always recommend you make no major financial decision without referring to MoneySmart. This is a government sponsored website from ASIC. It gives consumers all the information they need about financial matters.

If you follow the tips from MoneySmart, your Dream Home is unlikely to be your Nightmare Home.

Shelley Craft is the host to an informative set of videos.

- How to get a home loan

- Mortgages – How much can I afford?

- How to save for a home

- Buying a home – The hidden costs

- Helping your kids buy property

What’s Your Financial Dream

Home ownership is only one financial dream. I hope you are also thinking about how you can achieve your dream home, but at the same time achieve your dream retirement. Your dream retirement can only be achieved, if you take to time to plan your finances. You see to get the balance right for:

- Lifestyle expenses

- Home ownership

- Investing for retirement

- Saving through superannuation

Financial Mappers will help you do all that in one financial plan.

Watch Video

Financial Mappers has made a special video called “What’s Your Dream”…. just for you.

Glenis Phillips SF FIN – Designer of Financial Mappers

Further Reading

Check out these articles I have found for you:

- How to save for a house deposit (Bankwest)

- How to save up for a house deposit (Savings.COM)

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.